Start with Something Simple...

What % of members take their medication as directed?

That’s a reasonable thing to measure, right? An MA plan with a good formulary, good benefits, a good network of doctors and pharmacists and a well run pharmacy department should do fine. Right? This is straightforward enough. You have to make some assumptiosn that won't work for all drugs, but very common classes of medications for chronic conditions you can reasonably assume the vast majority of patients should be taking it daily forever.

Three Star Measures

- Medication Adherence for Diabetes Medications

- Medication Adherence for Hypertension (RAS antagonists)

- Medication Adherence for Cholesterol (Statins)

Star Ratings include three chronic conditions each with very common medications. Each is triple-weighted; collectively they represent about 9% of the 2023 Star Ratings. (it used to be an even bigger share) It also winds up being lion’s share of the 5x weighted Part D Improvement measure that is comprised of the few Part D measures.

All we need now is a way to define “taking as directed” and a solution for all of the “what if” conditions that come up. We’re talking about healthcare and quality measurement, so just expect something complicated -- there will be many of these “what ifs”.

This Tutorial has 3 Parts

- How Adherence is Measured

- Quirks about Adherence

- How Plans can Improve Scores (In progress)

Section 1 - Measurement

The Source of Truth

CMS calculates the official medication adherence scores for each plan through a contractor named Acumen. They follow the measure specification that is owned and maintained by the Pharmacy Quality Alliance. (PQA)

Ground Rules

- Use only data CMS has available

- Each year is self-standing (don’t use 2022 data for 2023 scores)

- No chart reviews or clinical evaluation

HEDIS Versus Adherence

It’s helpful now to contrast the infrastructure that gets HEDIS® rates versus that of Adherence. In both cases, CMS has adopted a 3 rd party methodology (NCQA and PQA) that defines the number crunching to get the percentage of members who receive something for a health benefit. HEDIS is handled by the plan and involves both medical and pharmacy data, but Adherence is done by CMS and applies to both MAPD with a medical benefit as well as Part D only plans. This makes a huge difference in the measurement. Health plans have much broader data available to them, and they have an incentive to make every effort to bring in the data to maximize results. Adherence is much more hands off. CMS takes in certain datasets, hands it to Acumen and gets the results back. That’s it.

Data

This limits us to the following data that CMS has readily available:

- PDE – Pharmacy Drug Events (pharmacy claims: drug id, fill date, days of supply). Plans already sends this to CMS daily. (or the Plans’ PBM sends it)

- Plan Enrollment spans

- CMS flags for ESRD, hospice, etc.

- Certain hospitalization data

What all of these datasets have in common is that they exist primarily for payment purposes, not clinical quality. They payment tie-in isn’t always obvious – for example hospitalizations is collated by CMS for purpose of DSH payments. This is very different from HEDIS, from CAHPS and other Star measures where with their own QI specific data.

Also note that a physician looking at a member’s chart might quickly spot a reason for discontinuing a drug. It could be a reaction or that the drug wasn’t working. But clinical chart review is simply outside the scope of Adherence measures. Only data that CMS consistently collects for other payment purposes is incorporated into the calculation.

Proportion of Days Covered

A member is considered “adherent” or “compliant” if his “Proportion of Days Covered” (PDC) is at least 80%. Calculating PDC is conceptually very simple (again):

- Add up pharmacy claims’ Days Supply

- Count the days

- Divide

For example:

- 30 day fill on the first of each month from January to October and patient forgets to take it in November and December.

- 30 days * 10 monthly fills = 300 total days

- 300 /365 = 82%

- Since 82% > 80%, the member is counted as Adherent

As with all other aspects of Star ratings, there are adjustments and caveats. For Adherence, you have to get the right denominator – what days of the year should we expect to see claims for the member to be “covered”. Then we need to find the right numerator. You can’t just add up the days supply. Instead you have to look at which days of the denominator can you reasonably apply those days of supply to. For example, a December refill can’t retroactively cover a gap in November. Finally, there are some limited cases where members are excluded because CMS has data that indicates that the adherence measure is not an appropriate measure of quality.

The actual specification is very different than the 1-2-3 steps above. Instead of just laying out the specs, I am going to explain by a series of “What Ifs.”

What Ifs…

Question: What if they’re not on the drug all year?

Answer: Only count days from “First Fill” to end of the year.

Question: But What if they disenroll or die?

Answer: Only count days from first fill until that date.

Question: But what if the Dr takes the member off the drug?

Answer: Only count members that have at least 2 fills. Assume it’s a chronic med. There’s no way to detect “deprescribed” versus “member just stopped taking it” from Rx claims.

Question: But what if they get excess days supply at the end of the year, does that count?

E.g. 365 days supply on 12/31

Answer: Adjust for overlapping fills (like a 30 days supply only 25 days after the prior 30 day fill). Do not count anything past 12/31. Extra supply will not backfill earlier gaps.

Question: But what if member switches drugs?

Answer: Start count over at new fill.

Question: But what if member is in the hospital? Or a Skilled Nursing Facility?

Answer: Don’t count those days.

Assume “on hand” supply is available when member returns.

SNF only skipped if CMS has the data.

Here’s an illustration right from the Tech Specs:

Question: But what if member is on 2 different drugs in the class?

Answer: Organize each separately.

Each day is “covered” if either drug covers the day.

Question: But what if member is on Hospice? Or on Insulin, has ESRD or Dialysis?

Answer: Medication Adherence isn’t a valid quality measure for these members. Exclude them entirely from the count. (Insulin just for Diabetes)

Question: But What if member is only enrolled a few months?

Answer: Scale each member by # of months enrolled. Do not count any spans under 3 months. (see the later “quirk” section for why that is important)

Question: But what if member get cash refill w/out scanning insurance card? Or they get the drug from the Veterans Administration, or some other source?

Answer: Basically this is a “tough luck” situation for the plan. If they get 2 fills from the plan early in the year and then Rx claims stop, the data will look like they stopped taking the drug. The plan’s main recourse is to have benefits that nudge the member towards using the RX benefit entirely. (or not at all – the problem is only when it’s mixed.)

Question: But What if Dr prescription is for half a pill? E.g. 15x10mg pills 5mg/day for 30 days.

Answer: It’s the “Days Supply” not the number of pills that count. It’s another “tough luck” situation if the pharmacist records it wrong.

Diagram of Medication Adherence

I hope it’s clear by now that there are two calculations. The “outer” calculation is how to take the adherent and nonadherent members to calculate the plan’s score. This is the simpler of the two:

The inner or member level calculation completes the picture. [1]

Data Quality

As we discussed, CMS is responsible for the official calculation. Results are reported monthly on “Patient Safety Analysis Web Portal” from CMS’ contractor Acumen. The January report will be close to complete, but claims data is never fully in (“complete”) that fast. Acumen continues to update the rates for 6 months and the final rate is posted in July.

Data completeness is critical. Plans should always run the rates internally and compare to Acumen’s. Some data errors can be corrected –missing hospital claims can be submitted to CMS by the hospitals (see “shadow claims” below), enrollment files can be fixed with CMS, etc. Also, the PBM who submits the PDE records can correct a mistake if it can be shown that the claim was submitted incorrectly. In my experience, fixing PDEs is a high effort and low yield approach. It’s far better to detect issues in and address them with the PBM in real time.

Section 2 - Patterns and Quirks

This may blow your mind:

Every member starts at 100% adherence.

It’s baked into the definition of the measure. A member’s denominator starts with the date of their first fill and ends on 12/31 or the member’s disenrollment date. Even if there’s only 1 day of supply in the first fill, it at least covers the fill date. So the member’s personal year-to-date adherence is 100% until the first fill runs out. The rest of the year is a contest to finish over 80%.

Who do you track Prospectively?

I just said that everyone starts at 100%. But that’s a half-truth. Before the year is over and all the data is in, you can’t say anything definitive about anyone. But you can – and really have to – prospectively track your adherence rate.

There’s an important decision to be faced: Do you count members who have 1 RX fill or wait until they have 2? If you start tracking members only when they meet the criteria of "have had 2 fills" then it’s possible there’s a gap from when the first runs out and the second starts.

The decision of whom to track in reports is not obvious. Here’s an example:

- John gets a 30-day Statin on January 30.

- John gets his 2 nd 30-day Statin on October 1st

It’s a reasonable decision to ignore John until his 2nd fill in October. That matches the official spec from PQA; he’s not really “in the denominator” until then and it’s possible that the 2 nd fill won’t occur at all and he’ll never actually makes it into CMS’ report.

But if you ignore him, you run the risk of him popping into the results at the end of the year having already missed too many days to possibly be adherent for the year. Whatever programs you have in place to support adherence will totally miss him until it’s too late to do anything. I recommend including “single fill” members for this reason. But in preparing members for outreach, consider whether it’s appropriate to include or not include based on what it is you’re doing.

Adherence Gaps & Transience

In Stars parlance, we use “gap” as a shorthand for “gap in care” to refer to a member not being compliant for a measure. Most Stars gaps are HEDIS measures, for example a woman who is overdue for a mammogram is a “gap” until she becomes up to date. I distinguish between “gap measures” and “non-gap measures” by whether you can run the measure logic during the year to detect members with a "gap" that can be "closed". Like most HEDIS measures, Adherence are "gap measures". If you run the same logic on year-to-date data, some members will be below 80% and thus have a gap. Once you’ve detected a gap, you have many of the same tools available as HEDIS measures like contacting the member or contacting the provider.

The quirk with Adherence is that gaps are transient. A member may be adherent as of 7/1 but then miss a fill and fall back to nonadherent and go back to being adherent with a subsequent fill. This is very different than the cancer screen which once closed stays that way.

Member-Level Algebra

There are a number of calculations that can and should be made for each member:

- Year-to-date PDC (and flag those that are < 80% as gaps)

- On hand supply as of right now

- Date that the most recent fill will (or has) run out

- Best-case and Worst-Case final PDC for the member at the end of the year

- Number of covered days required for the member to be over 80%

- Date at which the member cannot possibly get over 80%

Practically every plan does the first one. The plan’s PBM probably will supply it on a regular basis. The unsophisticated thing to do is to treat every member who is not adherent for the year as a gap. The more sophisticated thing to do is to take the other calculations into account and triage members. For two plans I've created sucessful outreach centered on the last item, which one of the pharmacists (I think Nickole?) dubbed "D-Day". More on this in the future “what to do” section.

Short Enrollment Spans

CMS excludes members from the plan’s score if they are not “in the measure” for at least 3 months. There’s a reason for this – the shorter time the member is in the measure, the more likely that the PDC will be over 80%. It’s not obvious, but I can demonstrate it mathematically. Once you wrap your head around this pattern, then everything else around Adherence will make more sense.

Let’s start with a few examples, and assume that members always get 30 day supply fills.

What happens if the member disenrolls from the plan after being enrolled only 1 month? He will be 100% PDC.

Consider this example:

30-day fill on January 15 th. The clock starts on 1/15 and ends on 1/31.

Denominator is 16 and all 16 are covered by that 30 day fill.

So the member’s PDC is 16/16 = 100%.

No matter what you do, every day except for 1/1 will have the same 100% result. The only possibility to score less than 100 is a 1/1 fill without a refill when it runs out on 1/31. In that case, the PDC is 30/31 = 97%.

Of course, Adherence only includes members with at least 2 fills. There could be a gap between the day the first fill runs out and the second fill date. But it doesn’t solve the problem.

Consider another example – a member who gets a 30 day fill every 40 days. Intuitively, we can see that he’s only taking his prescription 75% of the time and thus shouldn’t be deemed adherent. But what happens if he has 30 day fills on 1/15 and his second 40 days later on 2/24 and disnerolls on 2/28? His denominator is 44 days. His numerator has 30 covered days by the first fill, then 6 more from 2/24 to the end of February. 36/44 = 82% -- he’s compliant. Scratching your head? Here’s a table:

Even though the member’s real adherence is only 75%, the calculation puts him above 80% in most scenarios.

Do you see what’s happening? It’s subtle. Think about alternating pairs of spans as the member flips from being covered and not covered. (If there’s no gap, then it’s not a pair – just a longer covered span.) But there’s no possibility of an unpaired gap – if there’s never a covered span then the member isn’t in the measure.

In our example, the only scenario in which the member’s PDC matches his true 75% adherence is when his first fill is on 1/20 and his 40 days in the measure gives him exactly a full 30 day covered span followed by exactly a 10 day uncovered span. This happens when the gap span ends exactly at the end of the enrolled period – there are no “extra” covered days at the end included in the denominator. In every other scenario, we either don’t count some of the gap days in a pair, or we count extra covered days from the next pair. Either will result in a higher PDC.

That explains what happens with 60-day enrollment. But what happens with 90- or 365-day enrollment? Basically, you get more full pairs. Imagine that these are stuck in between. They will increase the numerator and the denominator in proportion to the member’s actual adherence. The difference between the member’s calculated PDC and his actual adherence gets averaged out and the PDC becomes more accurate. Here’s a graph that shows the # of days enrolled vs the calculated PDC for the same “30 every 40” membership:

Clear as mud? The big takeaway is:

- Shorter time "in the measure" spans inflate members’ PDC

- CMS doesn’t count spans under 3 months (so the first fill by Oct 1)

Plan’s Prospective Adherence

Someone once told me this:

"We were tracking adherence from Acumen’s website. But we saw that we were solidly 5-Stars in the middle of the year so we stopped worrying about it."

Given the previous section, you can see what folly this was. Partial-year members typically have a higher PDC than full-year members. So for the whole population, you will have many more adherent members and overall a higher score midyear than you will after 12 months. The plan’s measure score is just not that meaningful before the year is up.

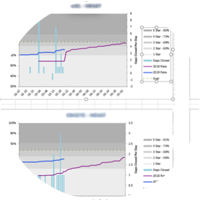

If you graph it, it’ll look something like this graph. Members "in the measure" (blue line) will start at zero and rapidly tick higher. At the same time, Adherence will start at 100% and drop as the year goes by. Your mission (should you choose to accept it) is to slow the descent and bend the curve so that that you don’t cross below the 5-Star line before Dec 31.

Proxy Measure

I use a slightly different measure during the year. Instead of the Star measure "% of members with PDC > 80%" I instead calculate the adherence percent as a daily rate. This is doable -- along the way of calculating a member’s PDC, you have to flag each member day-by-day as covered or not covered. Then I calculate for the entire populate the % of members that are covered on that day. This is something that can be graphed (as above) and is easier to interpret and compare to the prior year.

Members that Drop Out

There’s another notable difference with HEDIS gap measures. Most of them require the member to be enrolled (and alive) on 12/31. Adherence just requires 3 months – any 3 months. Of course, most members stay enrolled from 1/1 to 12/31, but there will be exceptions. A few – especially Medicaid eligible members – will make it in twice if they disenroll and reenroll in the middle of the year.

This is a challenge for prospective interventions that we’ll talk about in the next section. Your plan to get a member over 80% by year’s end might be ruined if he disenrolls at the end of November.

I hope this summary of the calcuation -- and the 'why' is helpful in undertsanding the Star measures. The may want to go back and retrace the abovce picture that shows the calculculation. But now that you've gotten a handle on how the measure is defined, what do you do about it?

Section 3 – What Plans Do About Adherence

Suppose your Stars analyst hands you a list of members with Adherence gaps. You have a few months left in the year and are not on track for your Stars goal. What can you do? There are some cards to play. They come in different shapes and sizes, but fundamentally you’re trying to exert influence through one or more of the following:

- The member or caregiver

- Member’s PCP

- Pharmacist at the point of sale

- Data

- Plan swag and marketing materials

- Benefits (for next year)

Member Outreach

Call the member. Identify the barriers to adherence. Counsel the member. Send a letter or a phone call to the member’s PCP with suggestions.

This is the most obvious and most comprehensive approach. Several plans I’ve worked with have employed pharmacists and pharm technicians this way. It can work, but it is labor intensive. To be successful, you have to have well thought out data collection and an efficient system for scheduling, tracking and recording. The systems I’ve built focus on barriers and resolutions:

- [ ] Cost

- [ ] Side effects

- [ ] Forgets to take

- [ ] Out of refills

- [ ] etc

The pharmacist interviews the member decides a course of action. There are several common responses.

- Counsel on the importance of taking drugs on time

- Schedule Appointment with PCP -- or help the member find a PCP

- Suggest alternative medications to the PCP if there are cost or side effects

- Send a weekly pill box or other swag to help the member keep on track

- Bring the member into a 3-way call to the local pharmacy to schedule a pickup

There are some pitfalls. The most obvious is the cost of making all these calls. Imagine the frustration on both sides of a call like this: "Mrs. Smith, I see you’re not taking your Statins regularly." “Yes I am, I refilled it yesterday.” It’s very critical for Adherence that the data be as up to date as possible before you make outbound calls. You don’t want to wait too long and have the member accumulate too many days to become adherent again. But you don’t want to call too early before the member is due for a refill. Nor do you want to waste resources calling members

Other Strategies

This tutorial is still under development. Check back later for a discussion of the following:

- D-Day concept

- Algebra

- Interventions

- Direct to member

- Point of sale

- Pill boxes

- Gap assessments

- Provider incentives

- 90 vs 30

- Mail order

- Benefits

- Chart searching

- Pill splitters, POS fix, etc.

NOTES

I created these images several years ago for Powerpoint to make it look animated. There's since been a change. When CMS/PQA/Acumen originally introduced hospice as an exclusion, they only excluded the days from the member calculation. A few years later they changed it to entirely exclude the members. This made more sense and aligned Adherence with HEDIS.